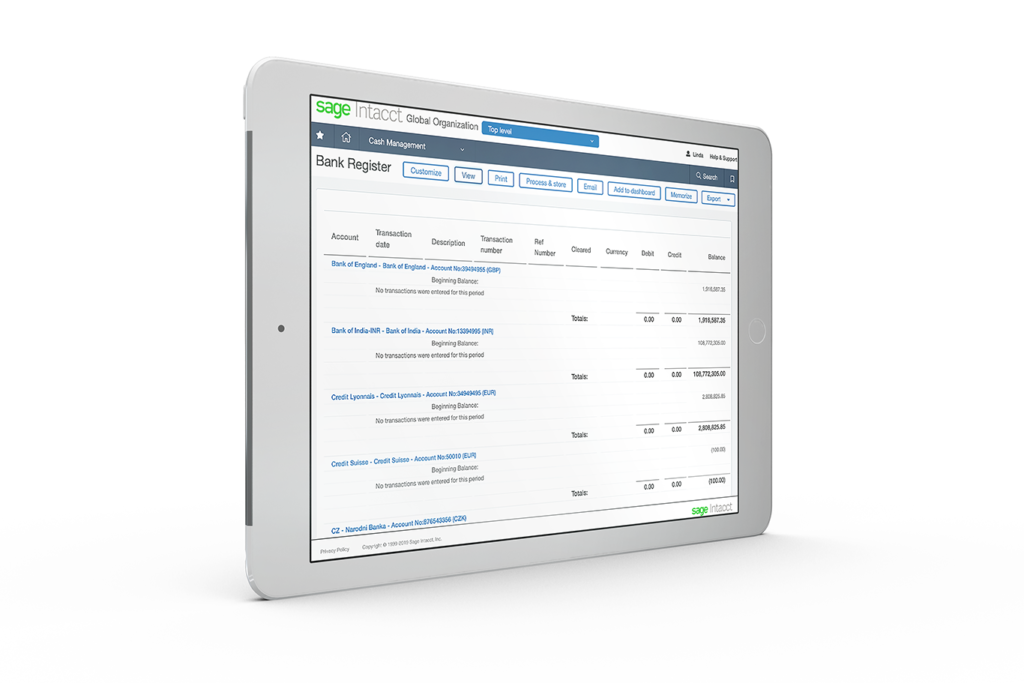

Go Beyond the Cash-Flow Statement

With Sage Intacct, you get a complete picture of your cash footprint and working capital. Where is the cash coming from? Where is it going? Sage Intacct cash management software moves you beyond the cash-flow statement to show a truer picture of your entire cash position.

Cash Management With Real-Time Insights

Get a complete, real-time depiction of your company’s funds and cash flows. Sage Intacct cash management shows you all payments and transactions across all checking and savings accounts and credit cards. Not only this, but you can see across locations and multiple entities- all in-real time so you’re always in control of cash. and across locations and entities.

Watch the customer testimonial:

5 minute Automated Bank Reconciliations

For easier cash management processing, import statements from your financial institutions and automatically reconcile your checking, savings, and credit card accounts. Spot exceptions, manage bank errors, monitor for fraud, and maintain accurate cash balances.

The Smarter Way to Manage Cash

Sage Intacct cash management solutions give you exceptional flexibility. Apply payments to accounts not tied to an invoice or record POS payments not applied to a single customer. Quickly print checks or use the bill-focused payment cycle. You can transfer funds across accounts to fund subsidiaries and branches, all with complete visibility.

“With Sage Intacct, our general managers and department heads hold greater accountability, because management can quickly pinpoint areas of financial concern and have accurate information with which to make better business decisions. As a result, three of our struggling entities moved into the black, our overall gross margins improved by 20%, cash flow increased by nearly a half a million dollars, and our real estate asset values grew by over $5 million.”

Larry Chank